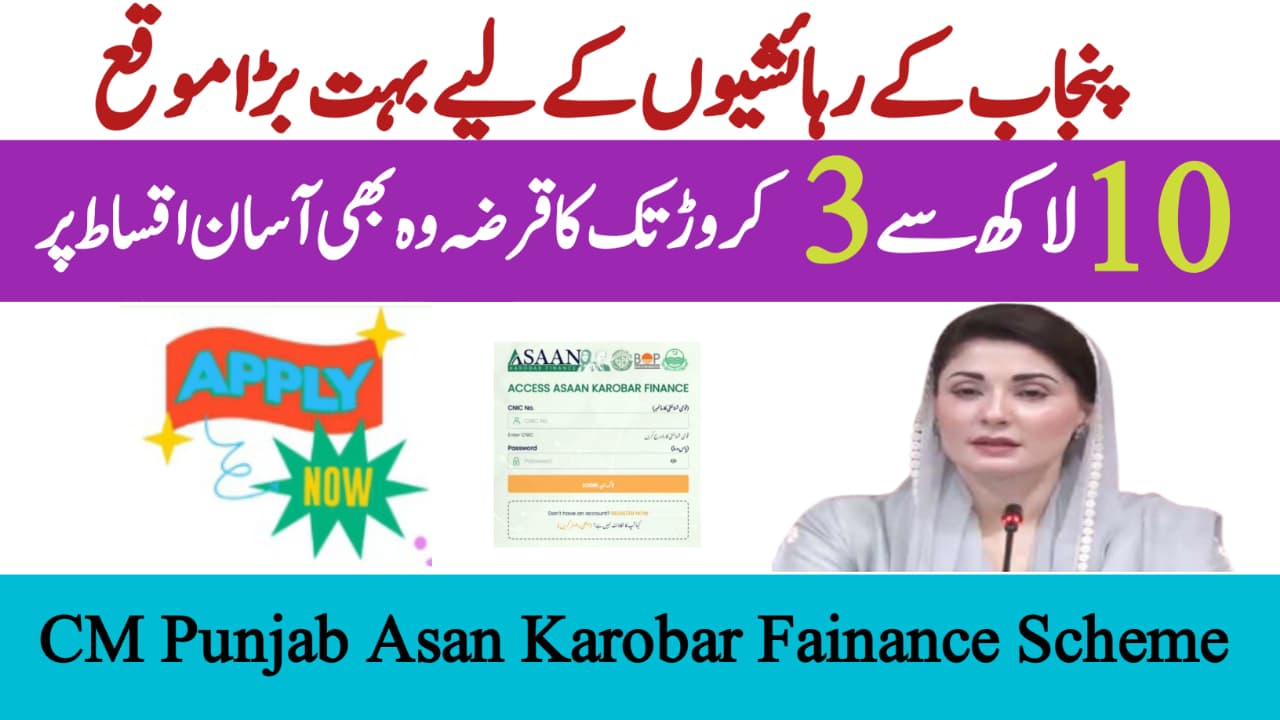

The Government of Punjab has launched a remarkable Easy Loan Scheme designed to provide financial support to the people of the province. This initiative aims to help individuals start or expand businesses, improve agricultural productivity, pursue higher education, or develop professional skills—all without the stress of heavy interest rates and complicated bank requirements.

This program comes as a major relief for residents who have long faced challenges in accessing affordable credit. With easy installment plans, minimal or zero interest rates, and a quick approval process, the scheme is a golden opportunity for those in need of financial assistance.

Purpose of the Scheme

The primary goal of this loan program is to empower the people of Punjab, especially those from low-income backgrounds, to become financially independent. Instead of relying on expensive bank loans or informal moneylenders, citizens can now obtain government-backed financing with fair repayment terms. This initiative is also expected to boost local businesses, create new jobs, and uplift the overall economy of the province.

Key Features of the Punjab Easy Loan Scheme

- Loan Amount: 50,000 to 500,000 PKR

- Repayment Period: Flexible terms ranging from 1 to 5 years

- Interest Rate: 0% for low-income groups; minimal markup for others

- For loans over PKR 200,000, collateral is not needed.

- Processing Time: Approval within weeks after verification

- Purpose: Business setup, education, agriculture, skill training, and more

Eligibility Criteria

To qualify for the loan, applicants must meet these basic conditions:

- Be a permanent resident of Punjab

- Age between 18 and 55 years

- Possess a valid CNIC issued by NADRA

- Have no history of loan default

- State a clear and legal loan purpose

Special Priority Will Be Given To:

- Women entrepreneurs and business owners

- Widows and orphans

- People with disabilities

- Small-scale farmers

- Students seeking higher education or vocational training

Types of Loans Offered

- Business Loans—For starting or expanding small businesses

- Education Loans—For tuition fees, books, laptops, and other academic needs

- Agricultural Loans—For seeds, fertilizers, equipment, and farming tools

- Skill Development Loans—For technical training and professional courses

Application Process

The application process is easy to understand and can be done both online and offline:

- Visit the Official Loan Portal—The Punjab Government will soon launch a dedicated portal for applications.

- Fill Out the Form—Enter your personal, financial, and loan purpose details.

- Upload Required Documents – CNIC copy, proof of residence, income proof, and purpose-related documents.

- Submit the application—either online or at designated centers.

- Verification Process—Your details will be verified through NADRA and other official records.

- Approval & Disbursement – If approved, funds will be transferred directly to your bank account.

Repayment Process

- Loan repayments can be made via banks, mobile banking apps, or at loan centers.

- There is no penalty for early repayment.

- There are flexible payment plans that can be changed to fit your needs.

Transparency and Fairness

To maintain trust and transparency:

- Lists of approved beneficiaries will be made public

- Applicants can track their application status online

- Third-party audits will ensure fairness

- No political interference will be allowed in approvals

Economic Benefits of the Scheme

- Encourages Entrepreneurship—Helps people start and grow their businesses

- Generates Employment – Creates job opportunities for skilled and unskilled workers

- Empowers Women – Supports women in becoming financially independent

- Supports Agriculture – Provides resources to increase farming output

- Promotes Education—Helps students achieve academic success without financial stress

Government’s Long-Term Vision

The Punjab Government plans to expand the scheme in the future by:

- Increasing maximum loan limits

- Offering micro-loans through mobile applications

- Providing free business training and mentorship programs

- Extending the program to more rural areas

Conclusion

The Punjab Easy Loan Scheme is a once-in-a-lifetime opportunity for individuals and families to achieve their goals without falling into high-interest debt traps. Whether you want to open a small shop, buy farming equipment, complete your education, or learn new skills, this program can help you get there.

For More Information Click Here